Industry News

News Categories

Featured News

0102030405

2025 Steel Market Outlook: Co - existence of Demand Structure Adjustment and Challenges

2025-01-14

In 2025, the Steel market is facing a situation where demand structure adjustment co - exists with numerous challenges under the combined influence of proactive macro - economic policies at home and abroad. The market trend is highly anticipated.

Manufacturing industry shows a good growth trend: Driven by the intensified and expanded "Two New" policies and proactive fiscal policies, the steel demand in industries such as automobiles, home appliances, energy, and machinery is on the rise. According to the prediction of the Metallurgical Industry Planning and Research Institute, in 2025, the steel demand in the automotive industry is about 59.8 million tons, a year - on - year increase of 4%; the steel demand in the home appliance industry will reach 19.4 million tons, a year - on - year increase of 8.4%; the steel demand in the energy industry is about 49.5 million tons, a year - on - year increase of 1.9%; and the steel demand in the machinery industry is about 179 million tons, a year - on - year increase of 1%. The "Two New" policies have boosted the consumption of steel varieties such as stainless steel plates, non - oriented electrical steel, oriented electrical steel, cold - rolled plates (automotive plates), galvanized plates, seamleSs Pipes, high - quality special - steel bar wires, etc.

- Infrastructure industry demand is expected to recover: In 2025, it is expected that the fiscal policy will be further relaxed. The state has increased the issuance of ultra - long - term special treasury bonds to support the construction of "Two Key" projects. Many provinces have released trillion - level project construction plans. For example, Hebei Province has selected 703 provincial key construction projects in 2025, with a total investment of 1.5 trillion yuan; Zhejiang Province will arrange the "Thousand - Project, Trillion - Yuan" projects for expanding effective investment in the province in two batches. This will lead to a certain degree of recovery in the Steel Consumption demand of the infrastructure industry.

- Steel demand in the real estate industry still faces pressure: Although policies have been implemented to promote the de - inventory of commercial housing and loosen credit for real estate enterprises, and the real estate market has shown some signs of warming, it takes time for the transmission from the sales side to the new - start side. Currently, the national real estate development investment is still weak. Although the new construction and construction area of real estate in 2025 are expected to recover to some extent, the overall steel demand is still expected to decline slightly compared with 2024.

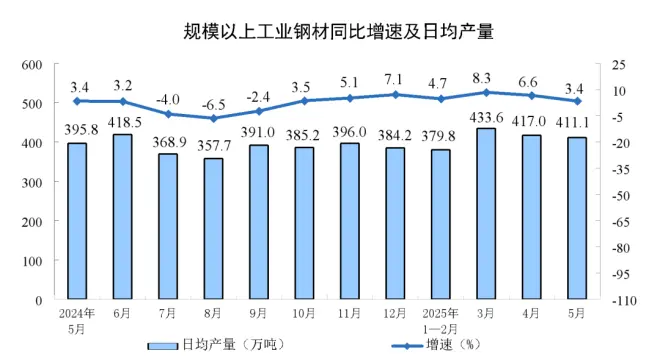

From the supply side, China's crude steel production capacity is still in the phase of clearance. In recent years, with the decline in demand, the crude steel output has also shown a downward trend. In 2024, the decline in pig iron output was greater than that of crude steel. The output of electric arc furnace steel plants was cleared more efficiently during the demand - decline period. Due to cost and profit factors, the output of rebar and hot - rolled coils in blast - furnace steel plants has diverged.

In terms of prices, the steel price showed a downward trend with fluctuations in 2024, with an annual decline of nearly 1000 yuan/ton. Looking ahead to 2025, it is expected that the fluctuation range of the main contract of rebar futures will be 2600 - 3600 yuan/ton; the fluctuation range of the main contract of hot - rolled coils will be 2700 - 3700 yuan/ton. The price trend may be high in the front and low in the back, and the low inventory will support the flexibility of steel prices to a certain extent.

Facing the complex market situation, steel enterprises are also actively seeking countermeasures. On the one hand, enterprises will accelerate the upgrading of steel products, improve product quality stability and reliability, etc., to meet the higher requirements for steel quality under the "Two New" policies. On the other hand, they will further optimize the product structure, increase R & D investment, and actively cooperate with upstream and downstream industries in the industrial chain. At the same time, they will establish a carbon management awareness, strengthen their own carbon management capabilities, actively respond to changes in national policies, enhance carbon asset management, and realize the value - added of resources.

Overall, in 2025, under the background of favorable policies and demand structure adjustment, the steel market faces challenges such as restricted exports and declining real - estate demand. However, the growth of the manufacturing industry and the recovery of infrastructure demand are expected to provide certain support to the market. Steel enterprises need to pay close attention to market dynamics, actively innovate and adjust strategies to seek development opportunities in the changing market and achieve sustainable development.

Contact Us for More Information

Email:manager@fsdsteel.com

Phone/Whatsapp:+86-19133613100