2025 steel price trend forecast: supply and demand challenges and future opportunities coexist

According to forecasts by the Metallurgical Industry Planning and Research Institute, China's steel demand in 2025 is projected to reach 850 million tons, with a year-on-year decline narrowing to 1.5%. Among this, demand from the construction sector is expected to drop by 3.2%, while the automotive industry, benefiting from the "Two New" policies (new energy vehicles and new materials), is anticipated to see a 4% increase in steel consumption. CICC predicts that the annual price centers for Rebar and hot-rolled coil may fall to 3,250 yuan/ton and 3,375 yuan/ton, respectively. However, declining raw material costs could alleviate profit pressures, leading to a moderate recovery in profit margins per ton.

In 2024, the challenges facing the steel market have intensified, with both enterprises and individuals feeling the strain. Whether industry giants or ordinary citizens, confidence in the economy appears to have been deeply tested. Issues such as the troubled real estate market, accumulating local debt, and persistently high youth unemployment have cast a shadow over market recovery. Against this backdrop, what challenges and opportunities will the steel industry face in 2025?

Since the beginning of 2024, pressure on China's steel industry has significantly increased, with a fundamental oversupply situation leading to worsening losses for many enterprises. Cheng Xiangqian, General Manager of Shougang Changgang, stated that rebar prices in the second half of 2025 are expected to perform better than in the first half, though the overall industry rebound remains uncertain. Cao Shuwei, Vice President of Jiangsu Yonggang Group, also offered a pessimistic outlook for the steel market, predicting that oversupply will persist in 2025, leaving little room for significant price increases.

Guided by policy, the steel industry is entering a phase of "reducing supply and increasing demand." Zhao Chao, Co-Chief Analyst of Metals and Coal at Changjiang Securities, noted that the transformation of the overall economic structure will drive supply-side reforms, necessitating long-term capacity reduction to adapt to profound economic changes. According to an analysis by China Construction Investment's annual report, steel prices in 2025 will fluctuate between long-term oversupply and domestic demand policies, maintaining a wide range of volatility. Forecasts suggest that the main contract price for rebar futures will range between 2,700-3,500 yuan/ton, while hot-rolled coil prices will fluctuate between 2,800-3,600 yuan/ton.

Additionally, key policy events to watch in 2025 include the Politburo meetings, the Central Economic Work Conference (expected in mid-December), the Two Sessions (expected in March), and the Federal Reserve's interest rate meetings in March.

According to industry annual reports, real estate will remain the largest consumer of steel in 2024, with consumption reaching 250 million tons. Although infrastructure investment will continue to be a crucial tool for counter-cyclical adjustment, its supportive effect may weaken. Narrow infrastructure investment growth in 2025 is expected to remain between 3.5%-4%, with new construction area likely declining by 7%-10% year-on-year.

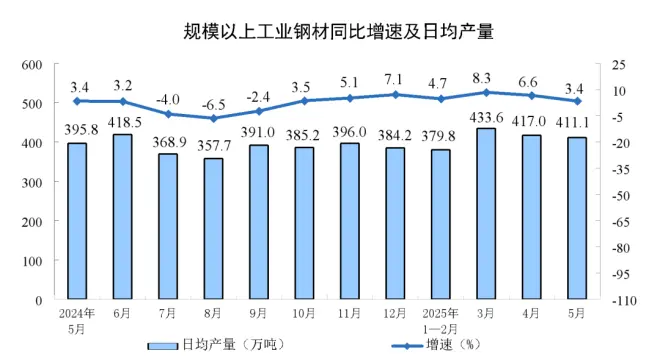

On the export front, China's steel exports in 2024 are expected to exceed expectations, reaching 106 million tons, an increase of 15 million tons year-on-year. However, exports in 2025 are projected to decline by 9.6 million tons. Meanwhile, crude Steel Production is expected to decrease by 1.3% to 990 million tons.

Looking at raw material prices, steel prices are expected to continue declining in 2025. The average price of Shanghai rebar is projected at 3,350 yuan/ton, a year-on-year drop of about 6%, while hot-rolled coil prices are expected to average 3,400 yuan/ton, down 7.4% year-on-year. Against this backdrop of weak supply and demand, the steel industry may face even more severe challenges.

The iron ore market is also under pressure. Global iron ore shipments in 2024 are expected to remain ample, with production reaching 2.584 billion tons, an increase of 52.15 million tons year-on-year. By 2025, weak demand will become more apparent, and market supply is expected to further increase, with global iron ore production exceeding 2.6 billion tons, a year-on-year increase of over 20 million tons. The average price is projected to fall to $95/ton, down 13.6% from 2024. For coking coal, supply is expected to increase by 10 million tons, while coke production may slightly decline.

The steel industry is currently in its sixth downturn since the 1990s. Faced with weakening demand, falling prices, high costs, and declining profits, steel enterprises are finding it increasingly difficult to improve quality and efficiency, with survival becoming more challenging. Looking ahead to 2025, a key event to watch is the "17th China Steel Summit" scheduled for March 21-22. The theme of the summit, "New Patterns, New Momentum, New Development," will bring together government leaders, economists, and industry leaders to explore the future development path and market trends of the steel industry. Against this broader economic backdrop, participants will share insights and experiences, aiming to chart a course for the industry's future.

Through an in-depth analysis of the steel industry's current state, it is clear that in 2025, the industry will face both the pressure of supply-demand imbalances and the opportunities for transformation and development. In this volatile environment, steel enterprises that can adjust their strategies, strengthen technological innovation, and improve product quality may find new market opportunities.