Forecast: The supply and demand game in the peak season steel market fluctuated slightly

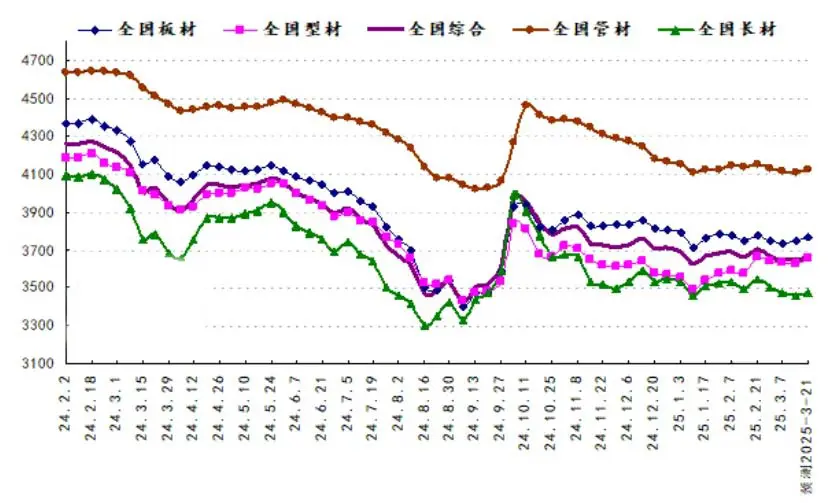

In the 11th week of 2025 (2025.3.10-3.14), the national absolute price index was 3,645 yuan, down 0.1% from last week and 9.6% from the same period last year; Among them, the absolute price index of Steel long products was 3,457 yuan, down 0.4% from last week and 8.6% from the same period last year; The absolute price index of steel profiles was 3,627 yuan, down 0.1% from last week and 10.3% from the same period last year; The absolute price index of steel plate was 3,746 yuan, up 0.3% from last week and down 10.3% from the same period last year; The absolute price index of steel pipes was 4,107 yuan, down 0.3% from last week and 10.1% from the same period last year.

The 2025 government work report scientifically puts forward the overall requirements, main expected goals and macro policy orientations of this year's economic and social development, and comprehensively deploys the key tasks for this year. The central bank should balance the relationship between short-term and long-term, stable growth and risk prevention, internal equilibrium and external equilibrium, and support for the real economy and maintaining the health of the banking system itself. In light of the domestic and international economic and financial situation and the operation of the financial market, we should take the opportunity to cut the RRR and interest rates, and comprehensively use a variety of monetary policy tools such as open market operations to maintain abundant liquidity, so that the scale of social financing and the growth of money supply can match the expected targets of economic growth and overall price levels.

Judging from the black futures disk, the main thread 05 closed at 3267, up 25 points per day, up 15 points from last Friday's closing price, and the weekly settlement price was 3231, down 51 points from last week. In the last three days of this week, it achieved three consecutive gains, reversing the previous decline. But further gains will require a steady above 3250 next week. Continue to pay attention to the pressure in the upper 3275-3300 range next week, such as the pre-pressure retracement, no less than 3230, it is difficult to return to the downward trend, and it is necessary to grasp the rhythm of change here. Once it stands above the 3330 mark, there is room for the weekly level to continue to rise.

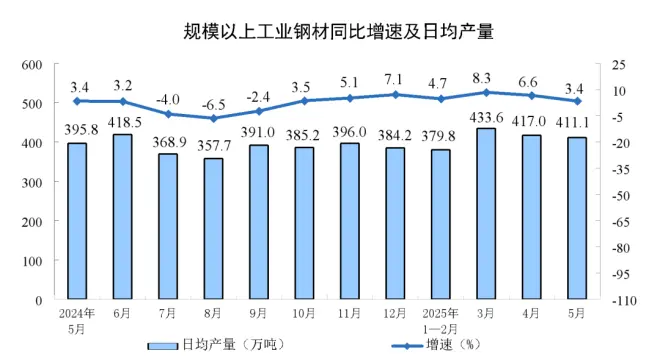

From the perspective of the steel spot market, the supply side: due to the impact of the profit and loss of varieties, the release of production capacity has weakened again, the output of hot metal has decreased, and the output of varieties has been mixed. Demand side: With the continuous increase in the release of terminal demand, social inventory continues to decline, and the transaction of varieties has also increased in an all-round way. Cost: Due to the slight increase in iron ore prices, the slight decline in scrap prices, and the stable price of coke, the support of production costs continued to weaken. Therefore, Lange Steel Research Center expects that under the influence of the expected RRR and interest rate cuts, the release of supply weakening again, the overall rise in market transactions, and the weakening of cost support, the domestiC Steel market may fluctuate slightly next week (2025.3.17-3.21).

Email:manager@fsdsteel.com