In the short term, the plate market will be dominated by fluctuations

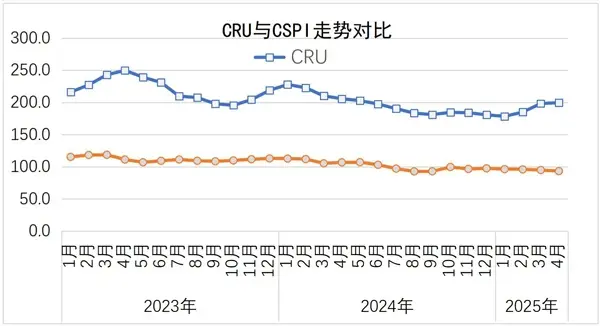

Since June, the domestic cold-rolled and hot-rolled coil market has been running smoothly overall, demand is still weak, market transactions are sluggish, cold-rolled and hot-rolled coil prices fluctuate slightly, and traders are basically cautious about the future market. On June 6, it is expected that the cold-rolled and hot-rolled coil market will mainly fluctuate in the short term.

Data show that in late May, the price of hot-rolled Q235B in Shanghai fell by 100 yuan/ton, and the price of hot-rolled SPHC fell by 90 yuan/ton. In early June, the price of 5.5 mm hot-rolled coil in Shanghai rose by 40 yuan/ton, and the price of 1.0 mm cold-rolled coil rose by 20 yuan/ton. "At present, although downstream demand is general and steel inventory has increased, steel production has not shrunk significantly because Steel Companies still have certain profits." Li Zhongshuang said that at present, the fundamentals of thesteel market, the situation of strong supply and weak demand, has not changed.

"During this period, downstream users are more cautious in purchasing, mostly based on rigid demand, and traders are not doing well. Some merchants choose to accept customer bargaining in order to ship goods and recover funds, and give discounts on steel transaction prices, resulting in a relatively common phenomenon of hidden price drops for cold-rolled and hot-rolled coils." In the short term, the cold-rolled and hot-rolled coil market is unlikely to see a significant improvement, mainly due to the following reasons:

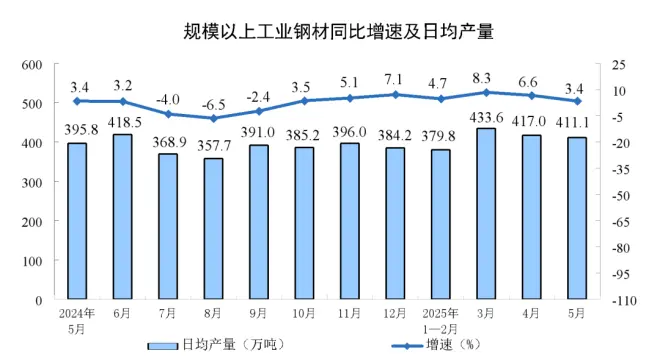

First, the supply pressure in the cold-rolled and hot-rolled coil market still exists. At present, driven by the profit-seeking effect, steel companies are not very willing to reduce production. According to statistics, as of May 23, the profit rate of sample steel companies was 59.74%, a slight increase of 0.43 percentage points from the previous week. Data show that in late May, among the six major regions of the country, except for the North China and Southwest regions where the average daily output of steel products of key statistical steel companies decreased compared with the previous ten days, other regions have increased to varying degrees. The continued growth in steel production will lead to increased supply pressure in the steel market, including cold-rolled and hot-rolled coils, or further decline in the prices of cold-rolled and hot-rolled coils in the later period.

Second, the market demand for cold-rolled and hot-rolled coils is weak. In June, the southern region entered the plum rain season, while the northern region ushered in high temperature weather. Weather factors directly affect the progress of construction sites, and also affect the rhythm of manufacturing production, inhibiting the release of downstream demand.

In addition, the current international tariff disputes are still ongoing. The United States announced that from June 4, it will increase the tariff on Steel And Aluminum products imported from all trading partners except the United Kingdom from the current 25% to 50%. The Ministry of Commerce said that the United States has once again raised tariffs on steel, aluminum and their derivative products.

It is expected that overall, the strong supply and weak demand pattern of cold and hot rolled coils in the short term will be difficult to change. In June, the contradiction between supply and demand of plates may be further aggravated.

Third, the rigid cost support has weakened. Recently, the prices of steel raw materials such as iron ore and coke have continued to weaken. According to statistics, as of May 28, the ex-factory price of ordinary carbon billet in Tangshan, Hebei was 2,900 yuan/ton, down 40 yuan/ton from the previous month; the price of scrap steel in Jiangsu was 1,980 yuan/ton, down 40 yuan/ton from the previous month; the price of first-grade coke in Shanxi was 1,100 yuan/ton, down 100 yuan/ton from the previous month; the price of 61.5% powder ore in Australia (Qingdao Port, Shandong) was 733 yuan/ton, down 29 yuan/ton from the previous month. The decline in the price of raw materials for steel has weakened the rigid cost support, making it difficult to support the price increase of cold-rolled and hot-rolled coils in the later period.