June Steel Market Outlook: Stabilization of coal prices is expected to drive stabilization of steel prices

May is the seasonal peak season for Rebar supply and demand. Although there is an expectation of a decline in demand, the actual supply and demand are not weak.

However, the price of rebar has not strengthened, and it continues the downward trend of the previous three months, showing a weak and volatile downward trend. As of the close of May 23, 2025, the price of the main rebar contract closed at 3,035 yuan/ton, down 1.97% month-on-month. From the raw material side, the price trend of "double coke" is weaker, and the price trend of iron ore is stronger. As of the close of May 23, 2025, the price of the main iron ore contract closed at 717 yuan/ton, up 1.92% month-on-month; the price of the main coke contract closed at 1,380.5 yuan/ton, down 10.24% month-on-month; the price of the main coking coal contract closed at 802.5 yuan/ton, down 13.76% month-on-month.

The main reason for the decline in rebar prices this time is the downward shift in costs after the collapse of the "double coke" price.

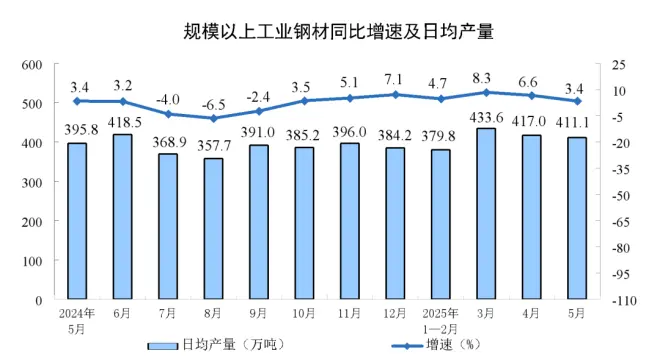

The guaranteed supply of coal has enabled domestic production to maintain its growth rate, coal mines have a high enthusiasm for production, and the output of raw coal has grown steadily. Data show that in April, the output of raw coal in industrial enterprises above designated size was 390 million tons, a year-on-year increase of 3.8%, a month-on-month decrease of 5.8 percentage points; the average daily output was 12.98 million tons. From January to April, the output of raw coal in industrial enterprises above designated size was 1.58 billion tons, a year-on-year increase of 6.6%. In April, the output of coke was 41.60 million tons, a year-on-year increase of 7.1%. From January to April, the cumulative output of coke was 164.431 million tons, a year-on-year increase of 3.2%. The increase in coking coal supply has led to an accumulation of inventory. According to statistics, as of May 19, the inventory of full-caliber coking coal was 35.475 million tons (all converted into clean coal), an increase of 2.853 million tons year-on-year.

The continuous decline in coal prices has led to a decrease in coal imports. Customs data showed that in April 2025, 37.825 million tons of coal were imported, a year-on-year decrease of 16.41%. From January to April, 152.671 million tons of coal were imported, down 5.3% year-on-year. The downward price has caused some coal production enterprises to suffer obvious losses. Coupled with the reduction of imported coal, the growth rate of coal supply has begun to slow down.

The demand for "double coke" can be divided into two levels. The first level is the demand for raw coal corresponding to the overall coal demand, and the second level is the demand for steel corresponding to the supply and demand of "double coke" varieties. In terms of raw coal demand, industrial thermal power above designated size fell by 2.3% year-on-year in April, and the decline was the same as the previous month. From January to April, the cumulative year-on-year decline in thermal power was 4.1%, and the decline narrowed by 0.6%. The demand for "double coke" by steel depends on the output of pig iron. From January to April, the output of pig iron increased by 0.8% year-on-year, of which April increased by 0.7% year-on-year. The demand for "double coke" can still maintain positive growth, but the overall demand for coal is weak.

Due to the increase in crude Steel Production, the demand for other raw materials is still supported, and iron ore generally shows a strong near-month and a discount in the far-month. The discount of the long-term reflects the market's concerns about the decline in future demand. The reason for the strength of the recent month is that the supply and demand are still supported. However, the recent shipment volume of iron ore to the port is not low, so it is difficult to independently support the strengthening ofsteel prices. From the perspective of raw materials, the price trend of "double coke" will have a greater impact on the price of rebar.

Looking forward to June, we are expected to see signs of improvement on the raw material side. First, the supply and demand of thermal coal has actually warmed up slightly. With the decline in prices, the import of coal has decreased, and the production profit of coal mines is not good. Second, June is the traditional peak season for coal demand. In order to cope with the high temperature in summer, downstream power plants will have a strong motivation to replenish their stocks at this time. Third, hydropower has been significantly sluggish since April. In May, the flow of the Three Gorges Reservoir returned to a low level, requiring thermal power support, which is beneficial to coal consumption.

From the perspective of the supply and demand of steel, the market is not as weak as imagined, and the supporting role is strong.

The latest data shows that in April 2025, the output of steel bars was 17.30 million tons, a year-on-year increase of 5.9%. From January to April, the cumulative output of steel bars was 65.385 million tons, a year-on-year decrease of 0.9%. However, the inventory of rebar is at a low level. According to statistics, as of May 23, the inventory of rebar in steel mills was 1.8776 million tons, a year-on-year decrease of 7.4%; the social inventory of rebar was 4.1646 million tons, a year-on-year decrease of 28.3%. From the perspective of apparent consumption, the growth rate of consumption is faster than the growth rate of production, and there is a slight gap between supply and demand.

From the downstream perspective, the downstream of rebar is mainly real estate, infrastructure, etc. The downstream of steel is spread throughout the entire industrial field, including real estate, infrastructure, automobiles, machinery, home appliances, shipbuilding, containers, etc. Except for the weak real estate data, most other industries still maintain growth. From January to April, both domestic demand for steel terminals and steel exports showed positive growth. Looking ahead, the international situation is relatively complicated, foreign trade is still in the process of "rushing for exports", and the market's expectations for the future are pessimistic. However, the current steel inventory is low, the macro policy stimulus has not been reduced, the central bank has cut the reserve requirement ratio and interest rates, and the realization of pessimistic demand has been repeatedly delayed. The author believes that the current pessimism may be exaggerated.

Looking forward to June, the black industrial chain may not be as pessimistic as the market atmosphere of the previous four consecutive months of decline. After the steel price fell and entered the cost collapse, the coal demand entered the peak season in June, and the coal price is expected to stabilize, which is expected to drive the steel price to stabilize. For rebar, the extremely low inventory plus the macro stimulus, if the infrastructure demand is strong, the rebar price is expected to bottom out and rebound.