Nippon Steel: U.S. tariffs may cause Japan's annual crude steel output to fall below 80 million tons

Imai Masa, president of Nippon Steel Corporation, said at a press conference on March 24 that the Trump administration's measures to impose tariffs onsteel, aluminum, automobiles and other products may reduce Japan's domestic crude steel output by millions of tons a year, and the total output may fall to less than 80 million tons. On March 12, local time, the Trump administration's move to impose a 25% tariff on all steeland aluminum imported into the United States officially took effect. At a news conference that afternoon, Japanese Chief Cabinet Secretary Yoshimasa Hayashi expressed regret and dissatisfaction that the US Government had begun to impose tougher tariffs on Steel And Aluminum than before, but had not implemented a "tariff exemption" for Japan.

Tariff shadow looms over Japan's steel industry facing a "triple shock"

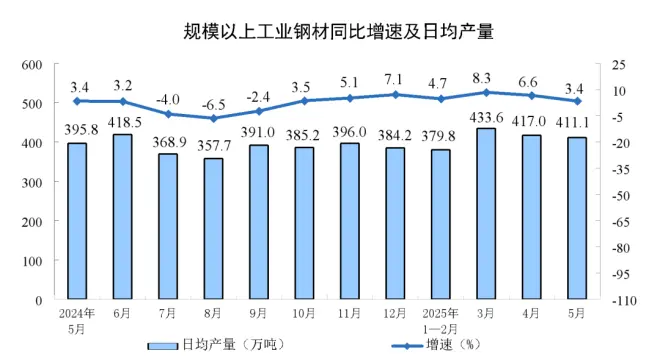

According to Nippon Steel's internal calculations, if the United States raises the current steel and aluminum tariff rate from 7.5% to 25%, Japan's steel exports to the United States will drop by 30%-40%. Coupled with the simultaneous tightening of trade barriers in major markets such as the European Union and Southeast Asia, Japan's total crude steel output may fall to 78 million to 79 million tons in 2025, down more than 10% from the actual output in 2023 (89 million tons).

According to data from the Japan Iron and Steel Alliance, the country's crude steel output peaked at 119 million tons in 1973, but continued to decline due to industrial relocation and shrinking demand. The U.S. policy will be the "last straw" that crushes the camel's back – 80 million tons is not only a psychological defense line for the industry, but also the minimum production capacity red line to maintain a complete domestic industrial chain.

The "butterfly effect" has hit the global supply chain

According to data from the U.S. Department of Commerce, Japan's steel exports to the United States will reach 2.2 million tons in 2023, of which special steel such as high-end electrical steel and automotive steel will account for more than 60%. This kind of product is widely used in the new energy vehicle production line of Tesla, General Motors and other car companies.

"The loss of the U.S. market will have a ripple effect." Kentaro Kobayashi, an analyst at Mitsubishi UFJ Morgan Stanley Securities, pointed out that Japanese steel mills may be forced to reduce investment in research and development of high value-added products, which will affect the technological upgrading process of global electric vehicles, power equipment and other industries.

The political and business circles urgently negotiated a response plan

In the face of the crisis, Japan's Ministry of Economy, Trade and Industry has set up a special working group to break the situation in three aspects:

Challenging the legitimacy of U.S. tariff policy through the WTO framework

Accelerate the signing of steel trade agreements with emerging markets such as India and the Middle East

Provide 30 billion yen in subsidies to support the transformation of hydrogen steelmaking technology for steel mills

Nippon Railway President Eiji Hashimoto stressed at an emergency press conference, "We will shift the focus of exports to the RCEP region, and at the same time implore the government to provide a tax credit equivalent to 50% of the amount of losses."

The global steel trade pattern is changing

The tariff turmoil reflects a deeper change: worldsteel predicts that developing countries will contribute 70% of global steel production for the first time in 2024. Japan's Nomura Research Institute warns that if it fails to adjust its strategy in time, Japan may be reduced from a "technology exporter" to a "raw material supplier".

At present, the steel companies of the European Union, South Korea and other traditional allies of the United States have also activated emergency plans. The tariff-induced storm is accelerating the rewriting of the global industrial map that has lasted for half a century.

Email:manager@fsdsteel.com

Phone/Whatsapp:+86-18831507725