The impact of the US tariffs on China's steel industry

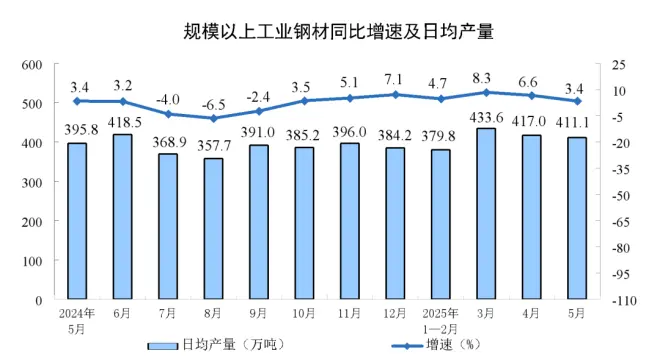

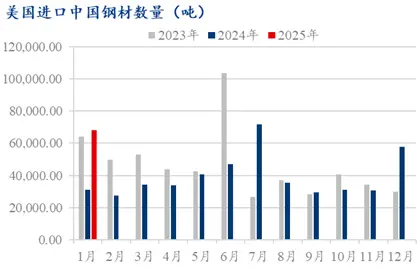

The U.S. government has recently adjusted its trade policy, with key changes including: Ending the "de Minimis" policy for China, Mexico, and Canada, where goods from these three countries must pay tariffs, regardless of value. However, the undervalue exemption still applies to other countries, but may face further adjustments in the future (note: the termination of the undervalue exemption for imports from Mexico and Canada has been suspended until March 2025). Increasing tariffs on imports from China, Mexico and Canada – Chinese goods are now subject to a 10% tariff, while Canadian and Mexican goods are subject to a 25% tariff (10% for Canadian energy products) (with the Canadian and Mexican tariffs suspended until March 2025). Strengthened Customs Surveillance – U.S. Customs and Border Protection (CBP) will strengthen oversight of import documentation, tariff classifications, and trade routes to ensure imports comply with the new rules. Subsequently, U.S. President Trump said that he would announce on the 10th that a new tariff of 25% would be imposed on all Steel And Aluminum imports to the United States, but did not disclose when the tariffs would take effect, and the new tariffs would be superimposed on the basis of existing metal tariffs, marking another "major upgrade" of Trump's trade policy reform, but China's direct steel exports to the United States account for a small proportion of total steel exports, and China's direct steel exports to the United States have declined year by year, and its proportion has dropped to 0.8% by the end of 2024. In 2024, China's total steel exports will increase by more than 20% year-on-year. However, China is accelerating the development of other international markets, and some products are re-exported to the United States through transit in other countries or regions.

We conducted a survey on export enterprises with large export volumes and key production enterprises by variety, and the survey showed that the impact of the US tariffs on China's steel industry was very limited, and most of the companies said that China's direct orders to the United States were small. Most of them are exported to Mexico, Canada, Brazil and other countries, and the issue of additional tariffs lies in re-exports, and the measures taken are mainly to balance domestic and foreign trade and coordinate customer tariffs.

Welded pipes: China will export 5.35 million tons of Welded Pipes in 2024 and 56,700 tons to the United States, accounting for about 1.07%. Through the investigation of production enterprises with large export volumes, the impact of the US tariffs on China's steel industry is very limited, and the current exports are mainly concentrated in the Middle East, South America, Southeast Asia and other regions, and the tariffs basically do not affect the normal export business of enterprises.

Seamless pipes: China will export 5.72 million tons of seamless pipes in 2024, and 107,300 tons to the United States, accounting for 1.88%. The main export seamless pipe categories are oil well pipes and drilling pipes, accounting for a small proportion of the total exports.

1. Cold rolling

China's direct exports of cold-rolled coils to the United States will be about 37,000 tons in 2024 and about 36,000 tons in 2023. Some of the export traders in the survey have no conclusion on the specific amount of tariffs, and they are still based on normal exports, and there is no feedback that the owner does not want the goods.

2. Coated strip coating

In 2024, 19.0652 million tons of coated sheets will be exported, and 129,000 tons will be directly exported to the United States, accounting for only 0.67%. The total export of coated strips to the United States was 37,000 tons, accounting for 0.47% of the total annual exports (7,806,400 tons). Coated strip exports to Southeast Asian countries, Trump announced on Monday that all countries will impose 25% tariffs on steel and aluminum imports, to a certain extent, affecting market confidence, but from the total export point of view, the tariffs have little impact on the overall coated strip.

3. Tin plate

In 2024, 85,000 tons of tinplate will be exported to the United States, a year-on-year increase of 157%, accounting for 5.2%, and the export of electrical steel will be 55,000 tons, a year-on-year decrease of 45%, accounting for 4.5%. At present, direct export and re-export orders to the United States are relatively maintained, and silicon steel is expected to grow by 20% in 2025.

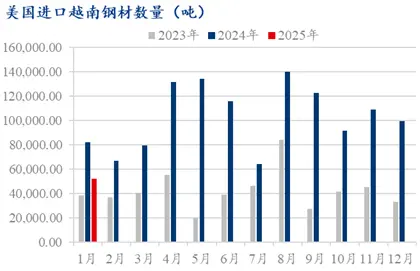

China's direct steel exports to the United States account for a small proportion of total steel exports, with only 0.8% of exports to the United States, and the main markets have shifted to ASEAN, GCC countries and along the "Belt and Road" (such as Vietnam, South Korea, and the United Arab Emirates). Judging from the current situation, in addition to direct exports, there are a certain amount of re-exports from Vietnam, South Korea, Mexico and Canada to the United States, and the impact on entrepot trade is expected to increase. As for its core point, it is mainly due to the fact that it may reduce the "trade deficit" structure, and the future tax may gradually spread to become its future bargaining chip. In the future, tariffs or anti-dumping incidents will also increase frequently, and even "traceable" tariffs will be introduced, which will have a greater impact on traditional exports.