Trade Frictions Throw a Spanner in the Works: Steel Exports Struggle Forward Under Pressure

Wang Guoqing, Director of Lange Steel Research Center, analyzed and pointed out that affected by multiple factors such as market supply and demand relationships and trade frictions, although China's steel exports in 2025 will face certain pressure, they will still remain at a relatively high level.

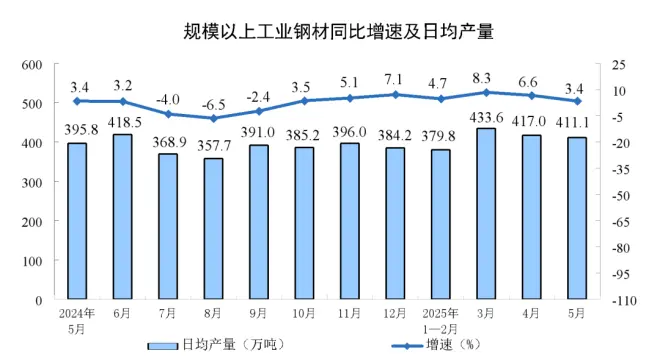

According to customs data, China's steel exports reached 110.716 million tons in 2024, a year - on - year increase of 22.7%; imports were 6.815 million tons, a year - on - year decrease of 10.9%. Among them, in December 2024, China's steel exports were 9.727 million tons, a year - on - year increase of 25.9% and a month - on - month increase of 4.8%; imports were 621,000 tons, a year - on - year decrease of 6.6%.

Overall, there are many positive factors for China's steel exports.

In terms of price, although the prices of steel at home and abroad have fluctuated and corrected, China's steel exports still have a price advantage. According to the monitoring data of Lange Steel Research Center, as of January 10, the export quotations (FOB) of hot - rolled coil in India, Turkey and the Commonwealth of Independent States were $507 per ton, $540 per ton and $485 per ton respectively, while the export quotation (FOB) of China's hot - rolled coil was $472 per ton, demonstrating the price advantage of China's steel exports and providing support for future exports.

There is also support at the supply - demand level. Wang Guoqing pointed out that the year - on - year decline in overseas Steel Supply has expanded, and there is still room for the release of external demand for Chinese steel. In November 2024, the crude steel output of 71 countries included in the statistics of the World Steel Association was 146.8 million tons, a year - on - year increase of 0.8%. Among them, the crude steel output in regions other than China continued to decline year - on - year. Data from Lange Steel Research Center shows that in November 2024, the crude steel output in the rest of the world except China was 68.4 million tons, a year - on - year decrease of 1.4%, and the decline rate was 0.4 percentage points larger than the previous month.

On the demand side, the global manufacturing PMI fluctuated within the contraction range, and external demand showed a weak recovery trend. The global manufacturing PMI released by the China Federation of Logistics and Purchasing in December 2024 was 49.5%, an increase of 0.2 percentage points compared with the previous month, reaching a new high since the second half of 2024. At the same time, the new export order index of China's manufacturing industry released by the China Federation of Logistics and Purchasing and the Service Industry Survey Center of the National Bureau of Statistics in December 2024 was 48.3%, a rebound of 0.2 percentage points compared with the previous month. Although it is still in the contraction range, it shows the slow recovery of overseas demand for China's manufacturing industry. In addition, the new export order index of steel enterprises surveyed by the Steel Logistics Professional Committee of the China Federation of Logistics and Purchasing in December 2024 was 50.6%, a rebound of 0.4 percentage points compared with the previous month. The short - term depreciation of the RMB has also enhanced the competitiveness of China's steel exports to a certain extent.

Although China's steel exports have advantages in terms of supply - demand and price, the inhibitory effect of trade frictions on exports cannot be ignored. Since 2024, the trade frictions faced by China's steel industry have increased significantly. In addition to Europe and the United States, countries in Southeast Asia, South America, Oceania and Africa have also launched trade sanctions. Tracking data from Lange Steel Research Center shows that in 2024, China's exports of steel and related products encountered more than 40 trade remedy investigations. Entering 2025, Thailand launched an anti - circumvention investigation on China's special iron pipes and Steel Pipes, South Africa launched a safeguard measures investigation on imported flat - rolled steel products, and Indonesia continued to impose anti - dumping duties on Chinese - related hot - rolled coil. The intensification of trade protectionism will further put pressure on China's direct and indirect steel exports in 2025.

Wang Guoqing said that due to the relatively low base of steel exports in the first two months of 2024 (with an average monthly volume of 7.955 million tons), China's steel exports in the first two months of 2025 are still expected to maintain year - on - year growth. However, as the base rises in March, steel exports may face downward pressure year - on - year. Against the backdrop of the intensification of global trade protectionism, Lange Steel Research Center predicts that China's steel exports in 2025 may be between 80 million and 100 million tons, turning from an increase to a decrease year - on - year.