What is the impact of anti-dumping duties imposed by Vietnam and South Korea on China's steel exports?

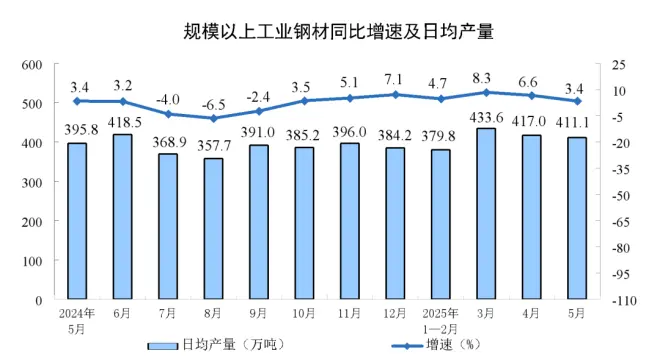

However, in recent years, with the gradual increase in China's steel exports to South Korea, the Korean industry has been dissatisfied, and South Korean steel enterprises and industry associations have long called on the government to take anti-dumping measures against imported steel. South Korea's steel imports from China reached 8.77 million tons last year, the highest in seven years, according to the data. South Korea is the second largest export destination for our Steel Products, second only to Vietnam in terms of export volume.

South Korea and Vietnam imposed temporary anti-dumping duties on some of China's steel products

On February 20, 2025, the Trade Commission of the Ministry of Trade, Industry and Energy of South Korea announced that it proposed to impose temporary anti-dumping duties on thick plates imported from China, with rates ranging from 27.91% to 38.02%.

On February 21, 2025, the Ministry of Industry and Trade of Vietnam issued Decision No. 460/QD-BCT to impose provisional anti-dumping duties on hot-rolled coils imported from China, with rates ranging from 19.38% to 27.83%. Effective 15 days after the date of publication (March 7, 2025) for a period of 120 days from the date of entry into force (unless extended, modified or cancelled in accordance with the law).

South Korea and Vietnam respectively imposed high temporary anti-dumping duties on China's medium and heavy plates and hot-rolled coils, which will have the following impacts on China's iron and steel industry.

First, the pressure at the outlet of steel increases.Second, the profitability of exports has declined.Third, the adjustment of market layout has been accelerated.

It is to recognize the global competitive situation. According to preliminary statistics, in 2024, China will suffer more than 30 original cases of trade remedies, exceeding the total number of cases from 2020 to 2023. The countries involved include Vietnam, Brazil, the European Union, South Africa, Australia, etc., covering major export varieties such as hot-rolled coils and cold-rolled stainleSs Steel. With the acceleration of the construction of various forms of international trade barriers, the export situation faced by China's steel industry will be more severe.

The second is to change the way of thinking. Iron and steel enterprises should adhere to the orientation of meeting the domestic market demand, organize production in accordance with the principle of "three determinations and three don'ts" of the China Iron and Steel Association, self-restraint and active production control. From the pursuit of "scale and output" to "variety and quality", on the one hand, it can better meet the higher and higher requirements of domestic and foreign users, and on the other hand, it is also conducive to alleviating the fierce competition situation in China. In addition, iron and steel enterprises can promote the global layout in a timely manner according to their own conditions, carry out international capacity cooperation, and make better use of the international market and resource conditions to participate in global competition.

The third is to do a good job in market demand research and judgment. During the "15th Five-Year Plan" period, different steel varieties, different subdivisions, and different regional markets will show different development trends and demand characteristics, such as the decline in demand for steel bars, but the demand for electrical steel, medium and heavy plates, and excellent steel rods and wires will generally remain at a high level; The demand in the construction field is insufficient, but the demand for new energy, new energy vehicles, shipbuilding and other fields is growing; The national demand for steel has declined, but the Yangtze River Delta, Guangdong-Hong Kong-Macao Greater Bay Area, Sichuan and Chongqing and other regions have developed manufacturing industries, and the demand for steel has great potential. Therefore, steel production enterprises should increase market demand research and judgment according to their own process and equipment conditions, combined with the characteristics of the regional industry, and orderly promote the optimization of variety structure and product quality improvement.

Fourth, resolutely safeguard legitimate rights and interests. With the rise of trade protectionism and trade frictions in various countries, iron and steel enterprises, industry organizations and government agencies should strengthen coordination and communication, improve response plans, and enhance response capabilities. Iron and steel enterprises should adhere to industry self-discipline, standardize the export order, avoid malicious competition, but also dare to struggle, good at fighting, in the WTO, steel industry forum and other multilateral levels, hold high the banner of maintaining free trade and multilateral trading system, for the export trade of steel products to create a fair and free international environment.

Fifth, make full use of strength. Give full play to the role of third-party resource platforms and think tanks such as the Metallurgical Industry Planning and Research Institute, carry out market decision-making research, and adjust the product structure in advance through analysis and prediction of changes in demand in downstream industries; Strengthen supply chain collaboration and logistics optimization, reduce logistics costs, and improve overall efficiency; Carry out green product certification, carbon footprint certification, etc., to meet the demand for low-carbon steel in downstream industries and enhance product competitiveness; Strengthen brand building and marketing, formulate brand strategy, and enhance corporate visibility and reputation; Actively participate in the formulation of relevant product standards of enterprises and enhance the right to speak in the market.